Blog

|

More Americans than projected filed first-time claims for unemployment insurance last week, a sign the improvement in the labor market will take time to develop.

Applications for jobless benefits increased by 25,000 to 410,000 in the week ended Feb. 12, exceeding the 400,000 median forecast of economists surveyed by Bloomberg News, Labor Department figures showed today. The total number of people receiving unemployment insurance was little changed, while those collecting extended payments decreased. A reduction in firings by U.S. firms is needed to keep unemployment going down. Bigger job gains are needed to boost consumer spending, which accounts for 70 percent of the world’s largest economy. "Conditions in the labor market will continue to be tenuous as firms look for a sustained pickup in sales,” Maxwell Clarke, chief U.S. economist at IDEAglobal in New York, said before the report. "Claims should remain at an elevated level for some time but should continue ... Read more » |

|

EXTENDED MASS LAYOFFS – FOURTH QUARTER 2010 ANNUAL TOTALS – 2010 Employers initiated 1,910 mass layoff events in the fourth quarter of 2010 that resulted in the separation of 295,571 workers from their jobs for at least 31 days, according to preliminary figures released by the U.S. Bureau of Labor Statistics. Layoff events and separations declined from fourth quarter 2009 levels. Fourth quarter 2010 layoff data are preliminary and are subject to revision. Read More..

Views: 420 |

|

Date: 2011-02-12

|

|

After a record breaking run during the course of 2010 and, indeed, the last 10 years, gold took a breather in January.

Part of the reason for the decline was a movement out of gold by investors in Europe and the US that had bought the metal as protection against further declines in the health of the global economic system. Sentiment improved and investors began once more to look at other asset classes that perhaps would offer better returns, prompting some commentators to question whether or not it is time to get out of gold. James Turk, CEO and co-founder of GoldMoney is not one of those commentators. Speaking at the Mining Indaba in Cape Town, Turk reiterated his view that gold will get to around $8,000 an ounce by around 2015 adding, "I would say though, having seen QE2, that my predictions will turn out to be on the conservative side." Speaking to Mineweb on the sidelines of the conference, Turk brushed aside concerns about a decline in investment dem ... Read more » |

|

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that total December exports of $163.0 billion and imports of $203.5 billion resulted in a goods and services deficit of $40.6 billion, up from $38.3 billion in November, revised. December exports were $2.8 billion more than November exports of $160.1 billion. December imports were $5.1 billion more than November imports of $198.5 billion.

Views: 369 |

|

Date: 2011-02-11

|

|

India's

industrial output in December rose a slower-than-expected 1.6

percent from a year earlier, government data showed on Friday.

The median forecast in a Reuters poll was for an annual rise of 2 percent. Manufacturing output, which constitutes about 80 percent of the industrial production, rose an annual 1 percent, the federal statistics office said in a statement. |

|

China increased its interest rates on Tuesday, for the third time since October, to curb the soaring inflation. The People’s Bank of China decided to raise the benchmark rates by 25 basis points. Now the one-year borrowing and lending rates has been increased by 25 basis points, which would come into effect from 10th February. China is experiencing fastest growth rate in 30 months. Following China, other Asian countries like India, Indonesia, Thailand and South Korea also raised the rates to curb the rising inflation.

The investors had major concern about the inflationary boom in the world and prompted them to mobilize their fund on precious metals. As a result, demand for precious metal increased, as precious metal is regarded as the safe heaven currencies. Contrary to precious metals, the hike in benchmark rates in China declined the demand for energy and industrial metal copper. The crude oil and copper price rallied down as increase in the rates would increase the investm ... Read more » |

|

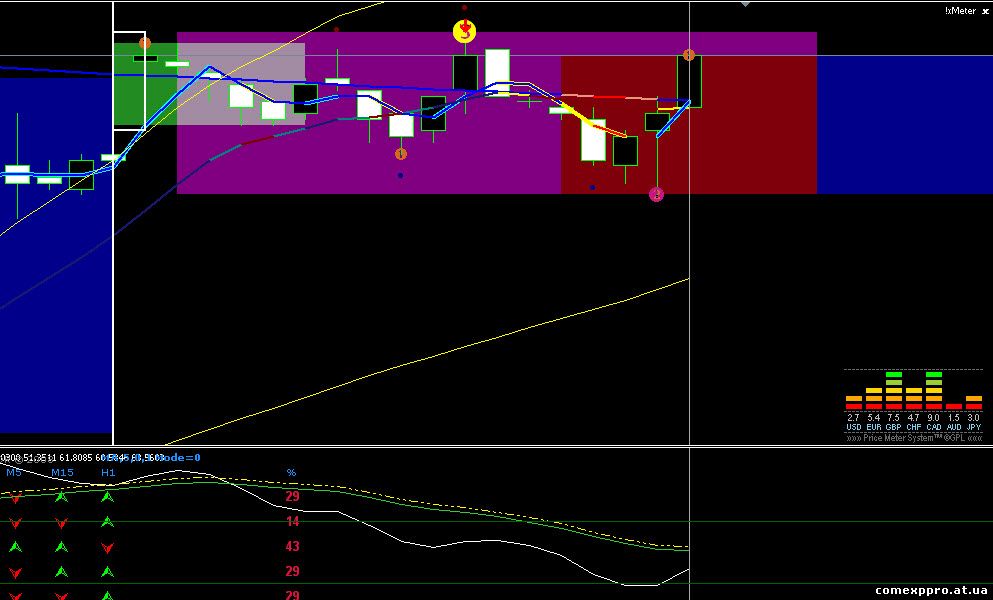

Support and Resistance

The basic way of analyzing the trend in the market is through Support and Resistance. Support and Resistance is one of the most widely used concepts in futures trading. Most of the technical tools are drawn based on the basic level of support and resistance. For e.g. The Relative Strength Index (RSI) take 30 and 70 as support and resistance lines respectively. Basically support refers to the lower point, form where it is generally anticipated that the price would not go below that level and Resistance refers to the upper point. Let’s have a look at an example:  The above diagram shows the bull market. We can see that when the market moves up, it returns after reaching the highest level (indicated by yellow line), which is the resistance. Likewise, the line rebounds as it reaches the lower level (indicated by yellow line) that is support. The support and resist ... Read more » |

|

n

Indicators: 1.Market_Price.ex4 2.Price Dashboard(2).ex4 3.Pondian 3 Maxima.mq4 4.BreakOut Gage.mq4 5.fan Simple Moving average.mq4 6.MA RSi.mq4 Success Ratio: 90% Order Now |